Credit Card Bureau

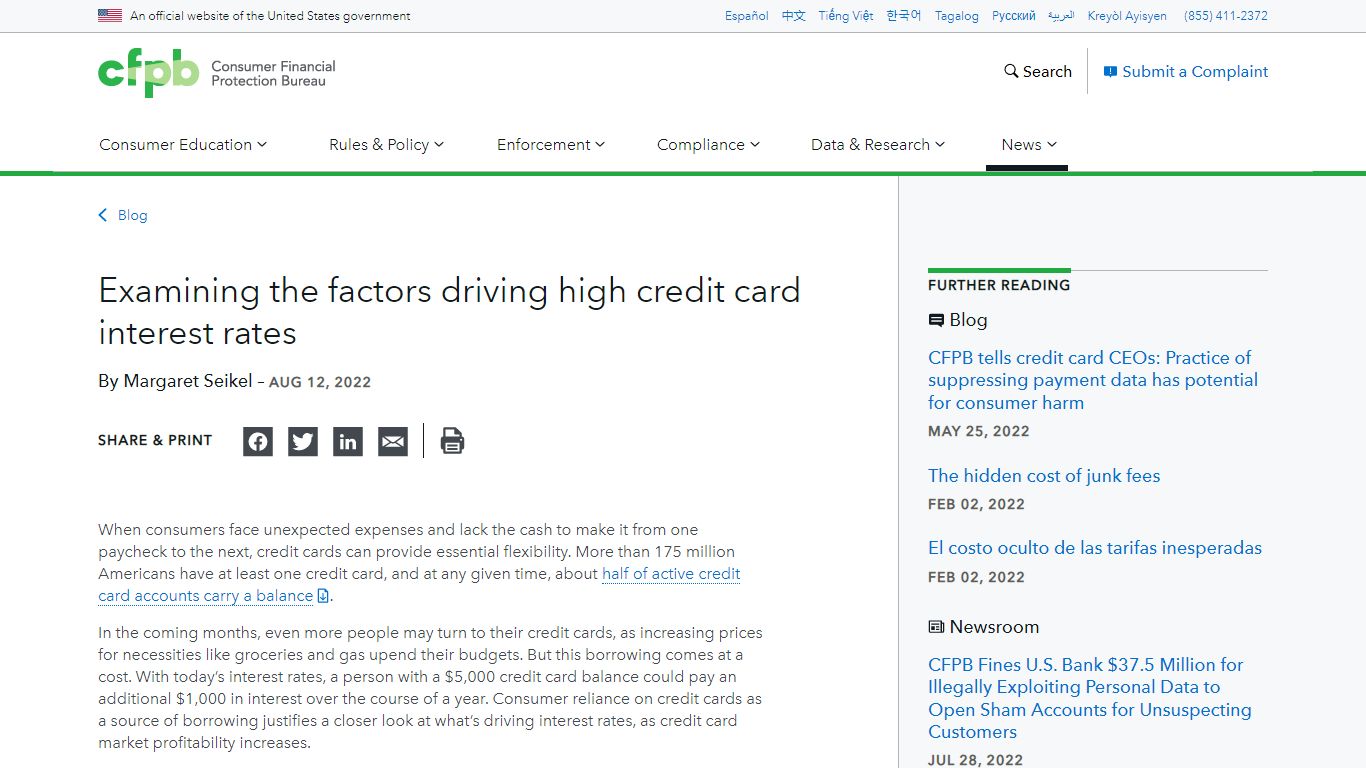

The 3 Major Credit Bureaus and What They Do - The Balance

Credit bureaus are the companies that collect and maintain consumer credit information from the lenders we use for credit cards, mortgages, and other types of loans. They help measure our perceived creditworthiness or the likelihood that we will pay our credit obligations on time.

https://www.thebalance.com/who-are-the-three-major-credit-bureaus-960416

Which credit bureaus do card issuers use to check your credit?

The three major credit bureaus – Equifax, Experian and TransUnion – supply the reports that card issuers review when considering your application. Typically only one credit report is pulled, but it’s hard to know which one. Here’s a roundup of what bureaus major card issuers use.

https://www.creditcards.com/credit-management/which-credit-bureaus-do-issuers-use/

Credit cards | Consumer Financial Protection Bureau

Understand how a credit card issuer calculates your interest rate Your interest rate is what you pay for borrowing money, and most companies calculate it daily. The sooner you pay all or part of your balance, the less interest you pay. Read more Learn the difference between a fixed and variable APR

https://www.consumerfinance.gov/consumer-tools/credit-cards/

The 3 Credit Bureaus: Why They Matter | Credit Karma

The three main credit bureaus, Equifax, Experian and TransUnion, draw on a wide variety of sources to build your credit reports. Credit-scoring models like FICO and VantageScore use these reports to calculate your credit scores. Your credit scores can vary by credit bureau, but this is normal. Check your credit reports often for errors.

https://www.creditkarma.com/credit-cards/i/three-credit-bureaus

Equifax | Credit Bureau | Check Your Credit Report & Credit Score

Your Credit. Your Identity. Choose which credit monitoring 1 and identity theft protection plan is right for you. Greater ID Theft Protection + 3-Bureau Credit Monitoring 1 Equifax Complete™ Premier Get 3-bureau credit monitoring 1 and ID theft protection features for one adult. $19.95 per month. Cancel at any time, no partial month refunds. 2

https://www.equifax.com/personal/

farmbureaubank.com | Choose the card that's right for you

To pay your credit card by mail, send the check and the remittance portion of your statement to: Farm Bureau Bank Consumer Card Services PO Box 37035 Boone, IA 50037-0035 To pay your credit card by phone, call 1-866-644-2535.

https://www.farmbureaubank.com/CreditCards

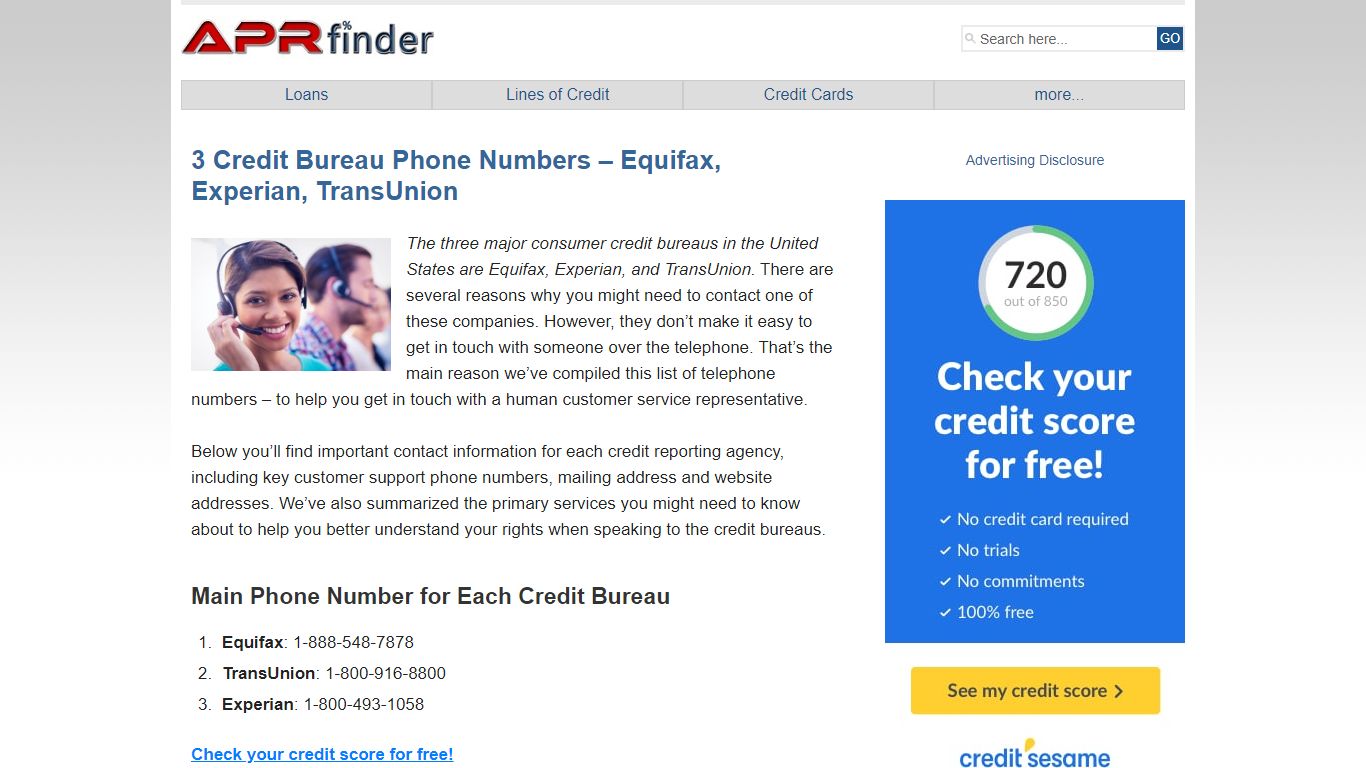

3 Credit Bureau Phone Numbers: Experian, Equifax, TransUnion - APR finder

3 Credit Bureau Phone Numbers: Experian, Equifax, TransUnion 3 Credit Bureau Phone Numbers – Equifax, Experian, TransUnion The three major consumer credit bureaus in the United States are Equifax, Experian, and TransUnion. There are several reasons why you might need to contact one of these companies.

https://www.aprfinder.com/credit-bureau-phone-numbers

When Do Credit Cards Report to the Credit Bureaus? — Tally

There are three major credit bureaus: Equifax Experian TransUnion Each bureau collects information on individual consumers and then produces a credit report. The details contained in the credit report are then used by the credit scoring agencies (i.e., FICO and VantageScore) to determine your credit score.

https://www.meettally.com/blog/when-do-credit-cards-report

How to Get the Best Credit Card with Bad Credit | Credit.com

Snapshot of Card Features. No credit check to apply and find out instantly if you are approved. OpenSky gives everyone an opportunity to improve their credit with an 85% average approval rate for the past 5 years. Get considered for a credit line increase after 6 months, with no additional deposit required.

https://www.credit.com/credit-cards-for-bad-credit/Examining the factors driving high credit card interest rates

In 2021, large credit card banks reported an annualized return on assets of near seven percent – the highest level since at least 2000. Earnings from credit card lending have almost always outperformed returns on banks’ other revenue streams. Interest income makes up the majority of revenue on credit cards, totaling about $100 billion per year.

https://www.consumerfinance.gov/about-us/blog/examining-the-factors-driving-high-credit-card-interest-rates/